Before partnering with us, it’s natural to have questions. Here are answers to some key concerns to give you clarity and peace of mind.

Jansen & Company CPAs selectively accepts new clients. If our priorities and professional skills align with your values and needs, we may be a good fit to work together. Our ability to accept new clients is most limited between January and April each year, so getting established as our client in the summer or fall is best!

Call (520) 325-0023 to schedule an appointment. If you have a current need for guidance or advice, a paid consultation will be necessary. If you simply want to meet one of our CPAs to get established for future tax services, we can schedule a 30-minute complimentary Meet & Greet.

Just like our services are not one-size-fits-all, our fees vary based on the complexity of your situation and the level of service you desire. Please review our services pages for more information about our varying levels of service.

We prefer in-person meetings for those located in southern Arizona, but we recognize that sometimes, phone and videoconference meetings may be preferable. We are available for those as well.

Our CPAs thrive on knowing our clients, and regular communication helps us to serve you better. Our tax return preparation includes (but does not require) at least one meeting with your CPA each year, either before or after completion of your tax return. We know some firms prefer to exchange paperwork and skip the meetings, but we prioritize being available to you!

Unlike many firms, we’re not just transactional. While you can give us your tax documents to prepare your return and then part ways until the next tax season, there are many other ways to work with us. We can be your ongoing partner throughout the year in all tax-related matters.

Our team is dedicated to making complex tax concepts comprehensive so you can feel confident to make informed decisions.

Every client will be assigned to one of our highly qualified CPAs as a primary point of contact. Our firm works closely together as a team, so during the course of our work, you may hear from our tax preparers, tax support team, or another one of our CPAs. Rest assured that we collaborate together every day to provide you with the best service possible.

Yes! We have a robust digital document sharing system that allows us to conduct all document sharing electronically, from collecting tax forms to signing the tax return and making tax payments.

While technology has its benefits, we realize it is not for everyone. You may continue to provide tax documentation on paper, and we will print your completed tax return at the end of the process. That being said, our firm embraces technology, and we may sometimes expect you to do the same. For example, we use e-mail communication to notify our clients of various updates, and we will encourage making online tax payments whenever possible.

We prepare tax returns in the order they’re received to make sure every client gets the attention they deserve during tax season. To keep things running smoothly, we follow a simple filing timeline:

Absolutely! If we determine that quarterly estimated payments are recommended, we will recommend amounts to you and provide payment instructions. As a general rule, we will base the payment amounts on the previous year’s tax, so more planning may be necessary if your income is expected to change.

Don’t panic! We make sure your returns are prepared correctly, help gather and submit any paperwork the IRS requests, and guide you through the process. Having a CPA by your side makes the audit far less stressful and ensures you’re supported every step of the way.

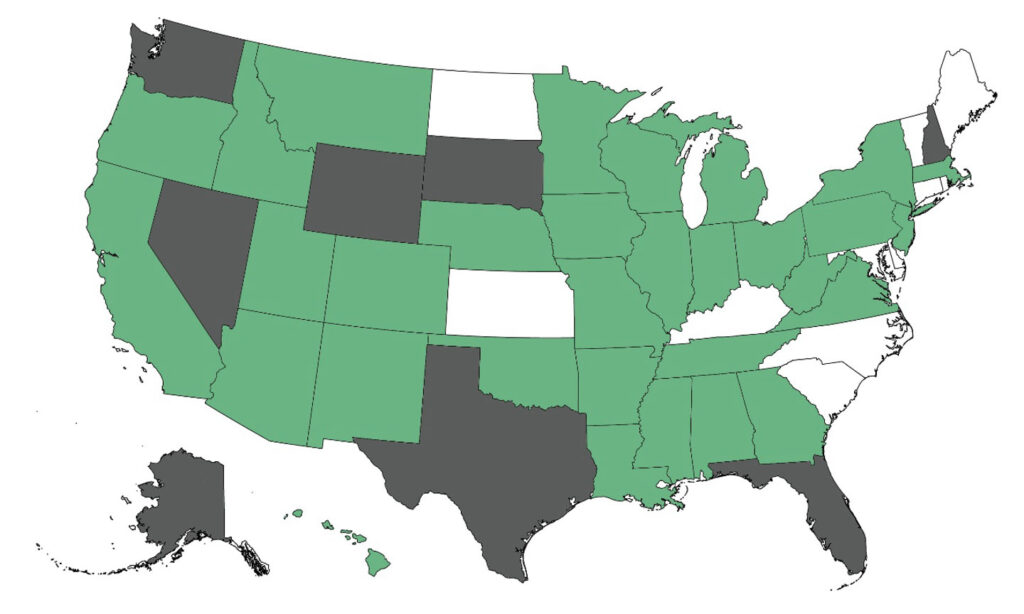

We are qualified and permitted to prepare and file returns in all states; however, we cannot maintain knowledge of all laws in all states. We are most familiar with the states in close proximity to Arizona. However, in the past few years, our firm has prepared tax returns in all the states shaded green in the image below. (The gray states have no state income tax). If complex state issues are involved, it may be more appropriate to hire a tax professional in the other state.

Our CPAs have extensive knowledge of tax law and a wealth of experience with unique situations. Depending on the situation, it may not be as unique as you think! Call us, and we’ll determine whether our team can address your unique challenges.

We work with small businesses with revenue anywhere between a few thousand dollars up to multiple millions, from startups to established companies, across a wide range of industries, including professional services, restaurants, retailers, software developers, real estate developers and small construction contractors. Whether you’re a small family business, a growing professional service firm or a larger corporation, we tailor our services to meet your unique needs.

We focus on income taxes and accounting. While we don’t provide payroll services, we can support you by connecting you with trusted providers. Our aim is to be your complete financial partner, not just someone you see once a year.

Absolutely. As CPAs, we’re authorized to represent you before the IRS. We’ll handle communication, prepare documentation and guide you through the process.

We offer both. Annual returns are just the beginning. Our real value comes from working with you throughout the year to plan ahead, solve problems and avoid surprises.

Yes, we work with numerous clients who own multiple business enterprises. While strategies do get more complex, we can provide advice and guidance about entity structure and best practices.

We prepare income taxes for a wide range of estates and trusts, including revocable and irrevocable trusts, simple and complex estates, and special needs trusts. We also prepare Form 706 estate tax returns for large estates. Our goal is to ensure compliance while minimizing taxes for beneficiaries.

We identify deductions, credits and strategies that reduce taxable income for the estate or trust. Proper planning can help preserve assets for beneficiaries and avoid unnecessary tax burdens.

Yes, we handle all required filings at the federal, state and local levels, ensuring compliance and accuracy so your estate or trust avoids penalties or delays.

Yes. Beyond annual filings, we help fiduciaries with tax planning, distribution strategies and compliance throughout the year to maximize benefits and reduce tax-related surprises.

We understand that serving as an executor or trustee for the first time can feel overwhelming. We are here to support you every step of the way, explaining tax obligations, reporting requirements and deadlines. Our aim is to make the process as clear and manageable as possible, helping you fulfill your duties with confidence and peace of mind.

Our tax planning services go beyond preparing returns. We offer strategic guidance on taxes, business finances, retirement planning and succession strategies to help you make informed financial decisions year-round.

We can offer guidance on how to optimize contributions, distributions and tax strategies for IRAs, 401(k)s, pensions and other savings plans to maximize your retirement benefits and minimize tax impact.

Absolutely. We help business owners structure finances, manage cash flow, and plan for succession, ensuring their business and personal tax strategies work together efficiently.

By reviewing your financial picture throughout the year, we identify opportunities for deductions, credits and strategies that can legally reduce taxes today and in the future.

It’s ongoing. We work with you throughout the year to adjust strategies as your financial, business and retirement plans evolve.